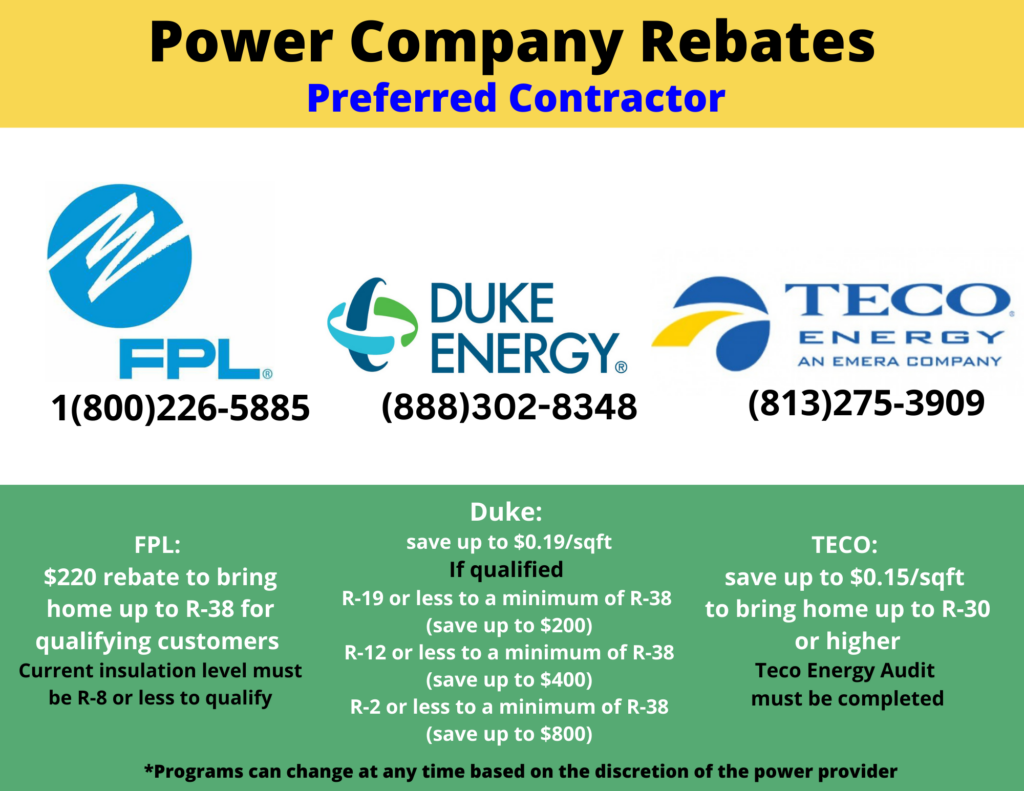

Homeowners looking to save money on energy bills and improve their home’s energy efficiency may want to take advantage of the insulation tax credit offered by TLS Insulation. As a prefered vendor with Duke Energy, TECO, and FPL, we are proud to offer these amazing tax credits! This tax credit is available for products purchased and installed between January 1, 2023, and December 31, 2032, allowing homeowners to claim up to 30% of the project cost, with a maximum amount credited of $1,200. It’s important to note that there are annual aggregate limits on the amount of credit that can be claimed, with a total limit of $3,200 per year.

Homeowners looking to save money on energy bills and improve their home’s energy efficiency may want to take advantage of the insulation tax credit offered by TLS Insulation. As a prefered vendor with Duke Energy, TECO, and FPL, we are proud to offer these amazing tax credits! This tax credit is available for products purchased and installed between January 1, 2023, and December 31, 2032, allowing homeowners to claim up to 30% of the project cost, with a maximum amount credited of $1,200. It’s important to note that there are annual aggregate limits on the amount of credit that can be claimed, with a total limit of $3,200 per year.

The tax credit applies to a range of insulation products, including batts, rolls, blow-in fibers, rigid boards, expanding spray, and pour-in-place. TLS Insulation can help homeowners determine which products are eligible for the tax credit and provide professional installation services to ensure maximum energy efficiency and savings. Stay up to date on tax credits for energy efficiency and other ways to save energy and money at home by subscribing to ENERGY STAR’s newsletter.